What are they for? your donations?

Your donation in action

What happens when you make a donation?

1 Operating on a child costs €12,000 (fixed price). When we raise this amount, we give the GO for the care of a child waiting for surgery.

2 The child is evacuated from his or her country by Aviation Sans Frontières and placed in the care of a volunteer foster family.

3 The patient is then operated on in one of our 13 partner hospitals in France or Switzerland.

4 After about a month's convalescence, he can return home in good health. He will be monitored by our teams for the rest of his life.

Every donation account

The more of us there are, the more children we can save.

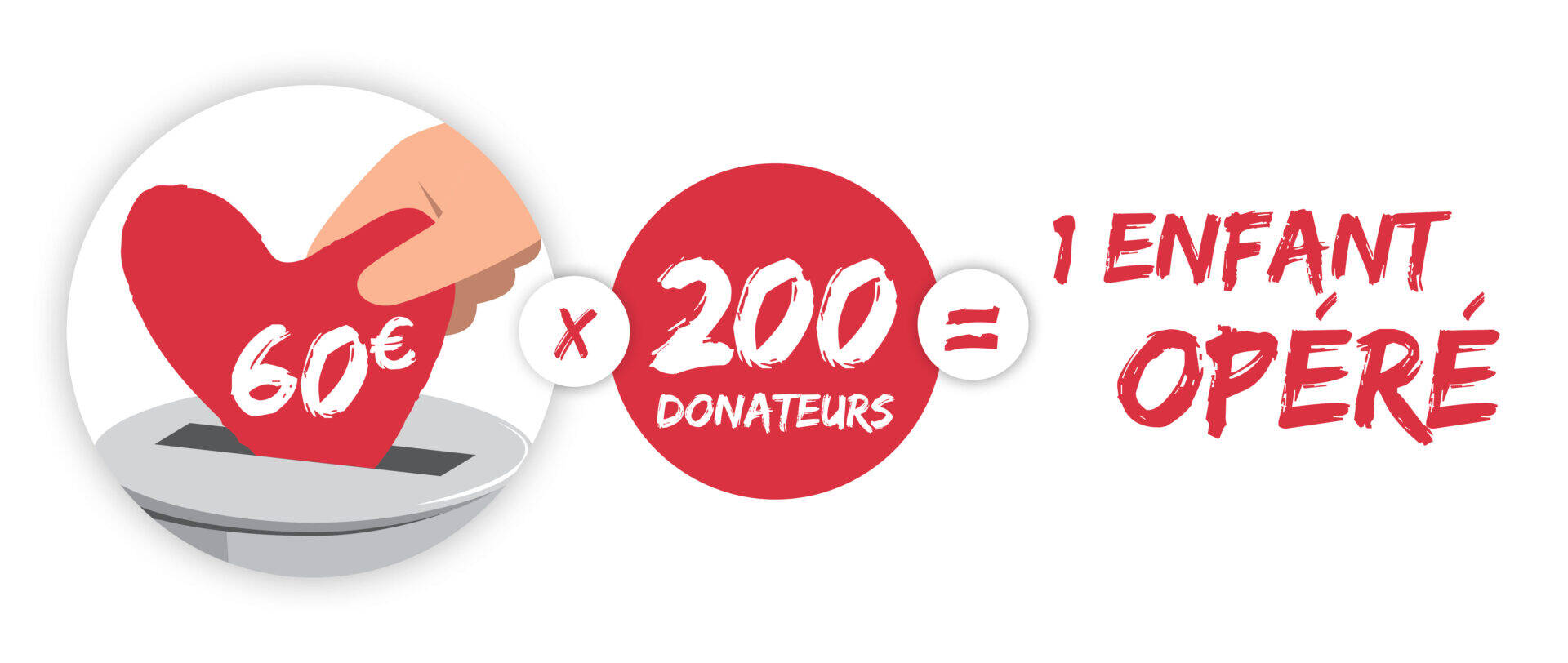

All it takes is 200 donations of €60 to raise the €12,000 needed to finance a child's operation.

20 (€5*) x 600 donors = 1 child operated on

60 (€15*) x 200 donors = 1 child operated on

120 (€30*) x 100 donors = 1 child operated on

1,200 (€318*) x 10 donors = 1 child operated on

*after tax exemption

How does your don is used?

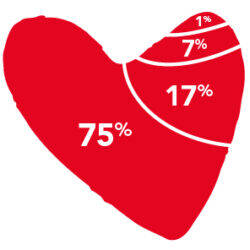

Rigorous, controlled management of the Association's finances enables us to optimize the use of donations, devoting 75% to our social missions.

The remainder is allocated as follows

- 17% for fundraising costs

- 7% for operating expenses

- 1% for provisions and taxes

Donate in full trust

Le Don en Confiance is a non-profit organization open to all causes of general interest. Its aim is to preserve and develop a relationship of trust with donors. In compliance with a Code of Ethics, its mission is to monitor public appeals for generosity, based on the principles of transparency, efficiency, probity and disinterestedness, and respect for donors, both natural and legal persons.

Mécénat Chirurgie Cardiaque has obtained the renewal of its label for a further 3 years in April 2022.

Donate and save

Mécénat Chirurgie Cardiaque is a public-interest humanitarian association legally and fiscally authorized to receive donations. This allows you to benefit from a tax reduction.

- For individuals: 75% of the donation - up to €1,000 - is deductible from income tax (and 66% over €1,000), up to a limit of 20% of net taxable income.

- For companies: 60% of the donation is deductible from corporation tax up to a limit of 5 ‰ (5 per thousand) of annual sales excluding tax or a ceiling of €20,000: whichever is more advantageous remains applicable. The excess can be carried forward for 5 years.

Your questions most frequent

-

How can I make a donation?

As an individual :

- By cheque, payable to Mécénat Chirurgie Cardiaque, to be sent to 33 rue Saint-Augustin 75002 Paris.

- Online (secure payment) on our donation form.

- By direct debit on our online donation form by selecting "I donate every month".

As a company :

- By instant transfer using our online donation form.

-

What should I do if my bank details change?

This situation only applies to donors who make a monthly donation by direct debit. If this is the case for you and your bank details have changed, please contact our Donor Service

(servicedonateurs@mecenat-cardiaque.org or 01 49 24 02 02). -

When will I receive my tax receipt?

On average, we issue and send tax receipts within 45 days of receipt of your donation. You will receive it by post or e-mail, depending on your preference.

If you have any questions, please do not hesitate to contact Ms Maud Boy on 01 49 24 90 31 or by e-mail at servicedonateurs@mecenat-cardiaque.org

-

Can I receive a duplicate tax receipt?

Have you mislaid your tax receipt or would you like to receive it again? No problem, just contact Maud Boy by e-mail at servicedonateurs@mecenat-cardiaque.org. Don't forget to include your contact details and the date or amount of your donation.

-

How do I fill in my declaration?

- Box 7UD: Donations to organizations helping people in difficulty

> Transfer the amount of the donation made to Mécénat Chirurgie Cardiaque in 2023, up to a maximum of €1,000.- Box 7UF : Other donations to public-interest organizations

> If your donation exceeds €1,000, enter the excess amount in this box.Examples:

Donation of €100 > €100 only in box UD

1500 € donation > Both boxes must be filled in: Box UD 1000 € and box UF 500 €. -

What happens to my personal data?

In accordance with the French Data Protection Act and European regulations, you have the right to access, rectify, limit, port or delete your personal data by contacting Mrs Maud BOY at mboy@mecenat-cardiaque.org.

Your data will not be shared with other charitable or commercial organizations.

Maud is here to answer your questions.